Imagine you’re a nonprofit university planning a capital campaign to build a new library. Knowing that most effective capital campaigns rely on large initial gifts, the university wants to raise approximately 50% to 70% of its campaign goal during the campaign’s “quiet phase” before moving to a broader public one.

However, the fundraisers are in a bind. Reaching out to everyone in their database would effectively push the campaign public before raising the necessary base funds. On the other hand, they don’t have the time or resources to manually go through each alumni profile in their database and decide who their wealthiest donors are.

Luckily, nonprofit wealth screening can help. This guide will explore the fundamentals of wealth screening for nonprofits, answering questions like:

- What Is A Wealth Screening?

- Why Should My Nonprofit Use Wealth Screening?

- What Are Wealth Screening Best Practices?

No matter your fundraising goals, a wealth screening can help you earn more. Let’s learn more about the process and how your nonprofit can get started.

What Is A Wealth Screening?

Wealth screening, a crucial element of the prospect research and fundraising process, helps nonprofits identify and target prospective and existing donors with the greatest capacity to give.

Nonprofit wealth screening tools leverage public record data, proprietary philanthropy databases, and data-driven algorithms to determine an individual’s potential for future giving based on a combination of their past information (such as giving history) and current assets.

What Is the Difference Between Wealth Screening and Prospect Research?

Wealth screening is an element of prospect research. While wealth screening focuses on financial information, prospect research also incorporates philanthropic information to determine a person’s willingness and capacity to give. If you want to narrow in on concrete information about a potential donor’s financial capacity to give, wealth screening is the right choice.

When conducting a wealth screening, there are the financial indicators that best predict a donor’s giving behavior:

- Business affiliations. Wealth screening can reveal information about donors’ careers, employers, and salaries.

- Stock ownership. Not only does stock ownership give you an idea of a donor’s relative wealth and ability to give, but it can also be a method of giving. As a registered 501(c)(3), you can accept donations of stocks and securities in addition to typical cash giving.

- Home value. Real estate ownership can be an excellent indicator of wealth. In fact, homeowners with over $2 million in real estate are 17 times more likely to give to charity than the average person.

Ideally, you want to target the cross-section of donors with high wealth indicators and high philanthropic indicators. However, depending on your fundraising goals, you may adjust this focus. For example, for a peer-to-peer fundraising campaign, you might contact retirees with smaller incomes but larger networks and more time.

Why Should My Nonprofit Use Wealth Screening?

Trying to determine major giving candidates based on your best guesses—or worse, inaccurate data—wastes time and resources. Instead, improve the efficiency and effectiveness of your fundraising campaigns by conducting wealth screening. With the data collected through wealth screening, you can focus your efforts on current and prospective donors who are the most likely to give.

Let’s take a look at a few specific ways wealth screening can benefit your organization:

1. Create Realistic Fundraising Goals

Because wealth screening can help your organization gain insight into current and prospective donors’ giving capacity, it can also help you set your fundraising expectations.

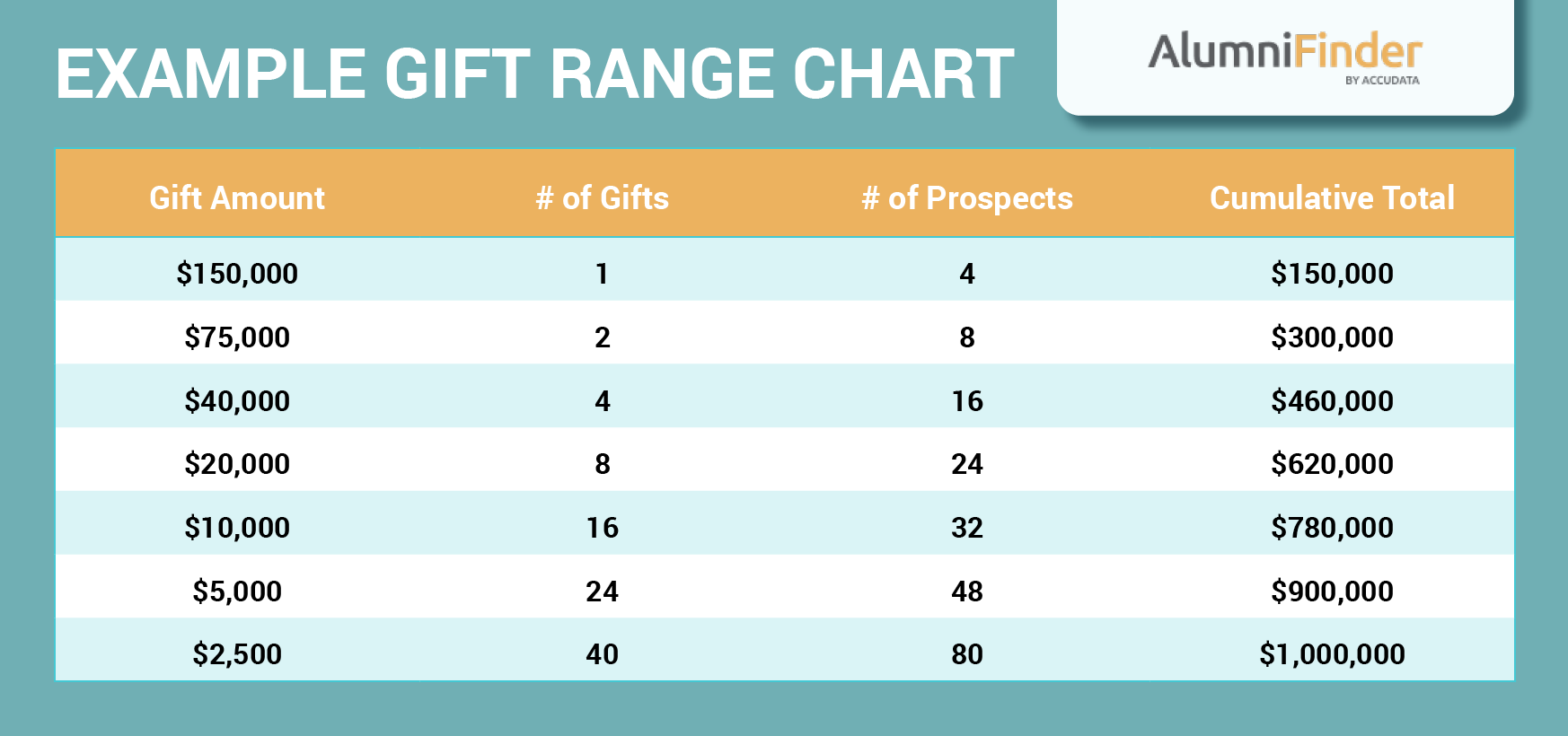

Use wealth markers to estimate the donation capacity of each person in your database to create a giving chart. This chart is a planning tool for major giving that helps organizations estimate approximately how many donations of various amounts they are likely to receive. For example, your example chart might show you have 50 donors with the potential to give $2,000 annually, 25 with $5,000 of giving potential, and 10 with $10,000 of giving potential or more.

This information allows you to establish realistic fundraising goals for your nonprofit or university. For instance, if you know you have many moderately high-level donors, you might plan to expand donor cultivation efforts, or if you find you lack major giving prospects, you might focus on new donor acquisition.

2. Plan Your Ask Strategy

An ask strategy includes when, how, why, and how much you request donors to give to your cause. If you ask for too much, you may turn donors away. On the other hand, if you ask for too little, you’ll leave money on the table.

Wealth screening data provides you with a better understanding of individual donors’ finances, allowing you to make donation requests that fit their budgets. For instance, if a donor has regularly given $50 a month, you’re more likely to receive a positive response if you ask them to upgrade to $65 per month rather than $100.

Additionally, you might find new giving opportunities supporters can take advantage of. These may include in-kind and stock donations, as well as workplace giving programs donors’ employers offer.

3. Determine Matching Gift Eligibility

Wealth screening can help you make the most of every donation by tapping into corporate giving programs like matching gifts.

Use wealth screening to identify supporters’ employers. Then, reach out to supporters who work for companies that offer matching gifts. Matching gifts are additional donations supporters’ employers will make to your nonprofit or university when their employees give. As a result, you can double—or even triple or quadruple—the impact of each eligible donation.

To increase donation revenue even further, embed matching gift software into your donation page. Donors can search their employers’ names or enter their work email addresses to be paired with their relevant matching gift information and confirm their eligibility. From there, most donors will need to complete a matching gift application hosted on their employer’s CSR software. After they submit the form, you just need to wait for the employer’s approval, and you’ll receive an extra donation.

All eligible donors can help by accessing matching gifts, and those with a high giving capacity will make an especially large impact.

4. Find Prospective Major Donors

Fundraising isn’t middle-school kickball. Major donors probably aren’t waving their arms in the air, saying, “Pick me! Pick me!”

Rather, you need to go out and find them.

Wealth screenings can help you quickly identify potential donors according to their current assets and past giving to organizations similar to yours. Donors with a strong giving history and high capacity are the most likely to be receptive to major gift requests. Identifying these individuals quickly and accurately will help your fundraising team better allocate their resources.

The more major donors your organization has, the better since their gifts alone may make up the bulk of your fundraising. In fact, major gifts of over $1,000 make up 85% of the average nonprofit’s revenue. With wealth screening, you can identify these giving opportunities and earn more for your cause.

What Are Wealth Screening Best Practices?

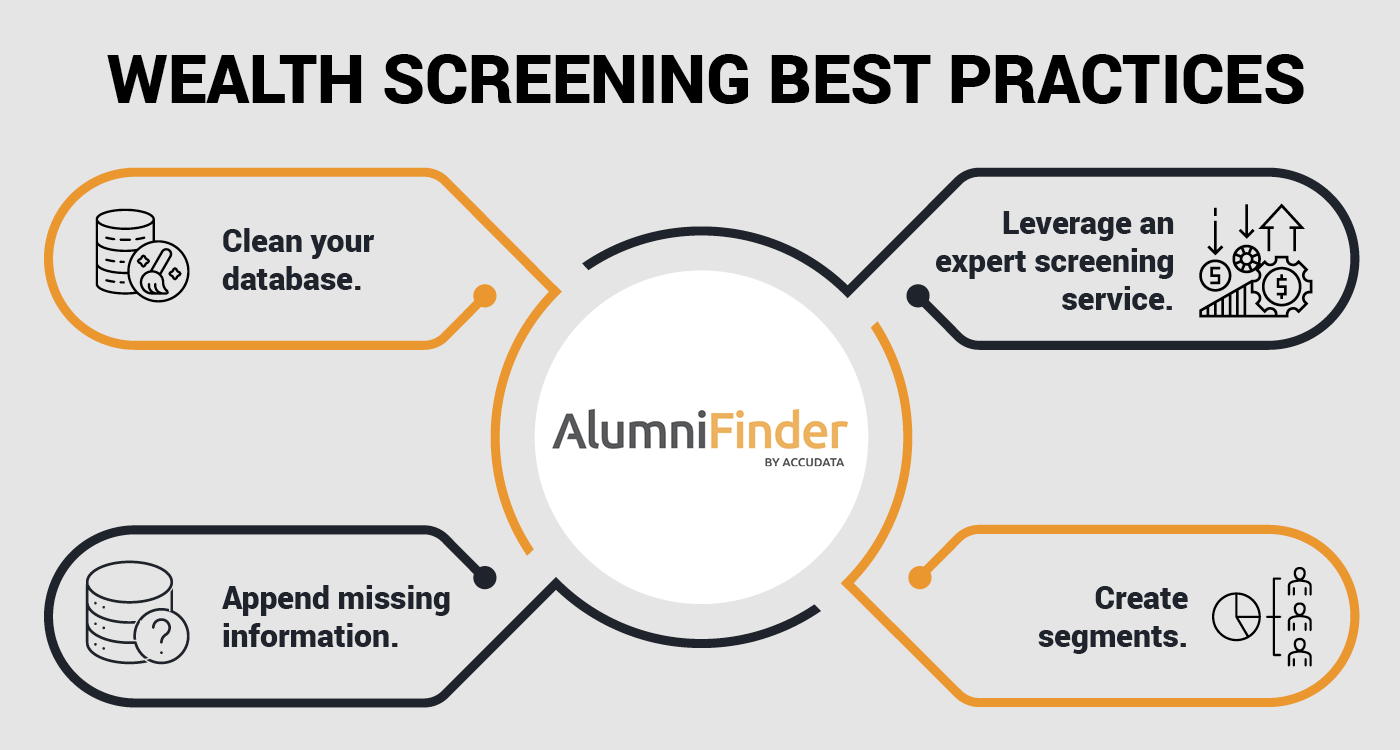

Now it’s time to conduct a wealth screening. Follow these best practices to ensure your efforts are a success.

1. Clean Your Database

Data hygiene is fundamental to a well-oiled wealth screening machine. When you have clean data, the results of your wealth screening will be more accurate and trustworthy.

Generally, the cleaning process involves evaluating the state of your current database, and then removing duplicate, inaccurate, and outdated data—also known as dirty data. When cleaning your database:

- Remove duplicate information.

- Purge lapsed (and deceased) donors.

- Update outdated/missing contact information.

- Standardize nonstandard entries.

Going forward, create detailed and specific data entry procedures and training materials that explain how anyone in your organization should collect, enter, and correct data. When you have proper data hygiene processes in place, you’ll ultimately save time and energy and put your nonprofit in a better long-term fundraising position.

2. Append Missing Information

In addition to wealth data, you should also have donors’ up-to-date contact information so you can reach out to them with donation requests. This includes the following:

- Preferred name and title

- Mailing address

- Phone number

- Email address

- Social media profiles

When you’re done cleaning your database, you might notice you’re missing some of this information. Without this data, you’ll have no way to reach potential donors and request their financial support.

Consider conducting a data append to fill in the gaps in your database. A data append service can help you source relevant contact information from third-party sources and add it to your database ahead of your wealth screening.

Then when the time comes, you can reach out to potential donors using a combination of email newsletters, direct mail event invitations, and social media posts. Supplement your outreach efforts with more personalized communication for major supporters, such as phone calls and in-person meetings.

3. Create Segments

Segmentation divides the vast ocean that is your database into smaller, manageable buckets. Specific segments help identify patterns and trends, so you can better target your wealthiest prospects. Nonprofits should segment data for wealth screening according to relevant financial indicators.

Additionally, you might consider segmenting your data into even smaller, more specialized categories for more targeted results. For example, within the larger engagement history category, you might break down supporters into the following categories:

- Recurring donors

- New donors

- Major donors

- Lapsed donors

- Event attendees

Ultimately, when you segment your donors, you can capture more detailed results, adjust your fundraising strategies according to different populations, and make the most of your screening.

4. Leverage an Expert Screening Service

Conducting a wealth screening yourself can turn into a labor-intensive, costly practice. Thankfully, there are screening services that can help cut down on costs, speed up the process, improve your results, and answer questions.

Instead of screening prospective donors one by one, screening services use software to screen hundreds or thousands of donors at a time, scoring each donor’s capacity to give.

Choosing the right wealth screening service can make a big difference. Not only does each provider have different processes, databases, and tools, but they also come from different industry backgrounds. For best results, nonprofits should use services with experience in the nonprofit industry.

Thus, to get the most out of your wealth screening experience, we’ve listed the features nonprofits should look for from their screening service provider:

- On-demand online access so you can search, analyze, and prioritize individuals or batches of donors whenever you need to.

- Manual verification processes of top prospects’ information for increased accuracy when identifying and cultivating major donors.

- Top-quality customer service that answers your questions, trains your team, and provides additional screening support at no extra cost.

- Integrated features that make it easy to import results into your existing donor management system.

- Prospect generators that help identify new major donors and planned giving prospects based on sophisticated modeling and analytics.

Ultimately, we believe that there’s more than one way to complete a wealth screening. The screening service you choose should offer custom tools and flexibility to meet your unique data-based fundraising needs.

Additional Resources

Wealth screening refines your donor outreach strategy by equipping you with the knowledge of current and potential donors’ capacity to give. As a result, you can be confident that you’re only reaching out to donors who have the ability to support your cause.

Want to learn more about how you can use wealth screening data effectively? Check out these additional resources:

- 4 Easy Ways to Leverage Your CRM for Alumni Engagement. Once universities conduct a wealth screening, they have a variety of useful information in their CRMs. Find out how to use yours to encourage alumni engagement in this article.

- From Inbox to RSVP: Drive Alumni Event Attendance with Email. Want to host a fundraising event for your newly identified potential major donors? Use your wealth screening data to conduct a successful event email marketing campaign.

- 3 Essential Text-to-Give Strategies to Boost Alumni Giving. Do you have wealth screening data and phone numbers for prospective donors? Take advantage of that information to leverage these text-to-give strategies.